Information about today’s podcast:

Dimensional Fund Advisors (DFA) - https://us.dimensional.com/

“The assets we(DFA)manage represent more than shares in a portfolio. That money represents the savings, sacrifice, and dreams that investors have entrusted to us. We take this responsibility seriously. Founded in 1981, Dimensional has a long history of applying academic research to practical investing. We offer a full range of equity and fixed income strategies designed to target higher expected returns.”

Apollo Lupescu, PhD, Vice President, Dimensional Fund Advisors:

Apollo Lupescu is vice president at Dimensional Fund Advisors, one of the premier investment managers in the world, managing around $650 billion in assets. He is a nationally and internationally recognized speaker who has delivered hundreds of lectures and seminars to financial professionals and individual investors on various investment topics. Apollo is considered “secretary of explaining stuff”, because he has a knack for explaining complicated issues in a clear and understandable way.

Apollo has been with Dimensional in Santa Monica for over 18 years, and prior to that he taught at the University of California. Apollo also served in a variety of roles with the US Department of State, from which he formed his own consulting firm, Apollo Consulting Group.

He received his PhD in economics and finance from UC Santa Barbara. Apollo also holds a BA in economics from Michigan State University, where he competed and coached water polo. Rumor has it that even to this day he is still playing, and more recently he is not only in the pool, but also learning how to surf in the ocean.

Top Investor Myths... Common Questions & Lessons Learned:

What does the evidence tell us about what to do in down markets? What do our innate biases tell us to do and why are they the opposite?

1. Myth -Successful advisors need to “time the market.”

Common Question: “Clearly, the stock market is going down and going to get worse, why not just go to cash...?”

The idea that an investor wants to avoid downturns in the market is an understandable and reasonable response. The challenge in the execution. Most of the time, it turns into a bigger loss and more stress than staying invested. In summary, mistiming the market comes with punishing consequences.

From our experience, when someone sells their equity positions to relieve stress, they simply replace the stress of being in the market with the stress of being out of the market and wondering when they should get back in. There is no magic signal. In other words, they exchange one stress for another.

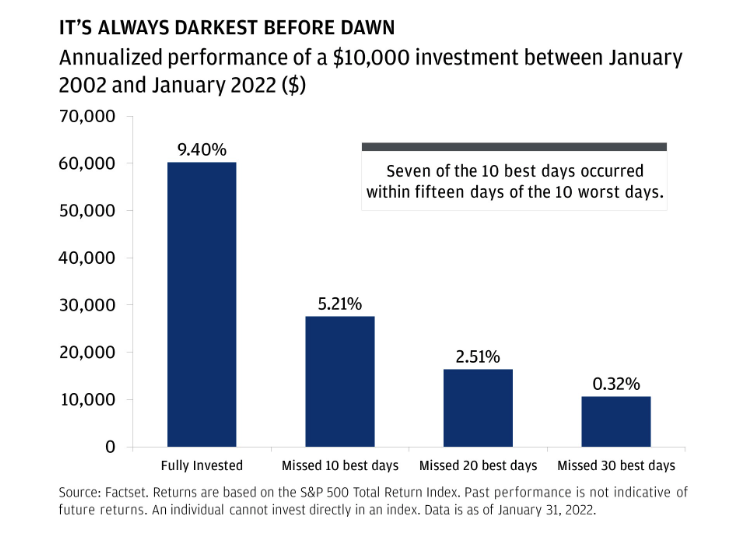

We miss the best days in the market... therefore “portfolio performance could be decimated.”

See JPMorgan “The Case For (Always) Staying Invested” at https://www.jpmorgan.com/wealth-management/wealth-partners/insights/the-case-for-always-staying-invested#infographic-text-version-uniqId1663780633203.

This chart shows the annualized performance of a $10,000 investment made between January 2002 and January 2022. A fully invested investment returned 9.4% or $60,253. When the investor missed the10 best days, the return is 5.21% or $27,604. When the investor missed the 20 best days, the return is 2.51% or $16,414. Finally, when the investor missed the 30 best days, the return is 0.32% or $10,651. An added fact is that seven of the 10 best days occurred within 15 days of the 10 worst days.

2. Myth - The Fed funds rate changes and impacts on bonds and stock returns.

Common Question: “So, the Fed raises rates because the economy is strong enough to stand on its own and the stock market tanks? That doesn’t make sense?”

The expectations of the Fed’s actions, commitment, and plan to fight inflation are very important. For example, if consumers, employers, and investors believe inflation is here to stay, then in many ways, it becomes a self-fulfilling prophecy. If we have confidence and believe the Fed is going to take strong action to fight inflation, then people’s behaviors (spending patterns) will fall in line with those expectations as well.

What does recent history tell us about stock market (S&P500) performance and rising interest rate environments?

Rising interest rates can and will cause short-term pain in the economy and sometimes the stock market. However, in the most recent rising rate environments the stock market has been up. From January 2000 to December 2021, five out of six years of rising interest rates the market did not drop.

As an investor, “...it is critical to remember that the stock market is about purchasing ownership in public companies. And the value of the ownership depends on the profits that the company expects to make. And we'll come back to this because it is a crucial concept. If you think in terms of the value of a company like Apple, Google, Facebook, you name it, Coca-Cola, etc., it is tied to the profits that they make. The question is, is the federal funds rate a primary variable that you can link directly to the profits of the company, and are they tied directly into what that interest rate does? And what the data seems to suggest is that it is quite likely that the fed fund rate does have some impact on the profits of a company, but there does not seem to be a primary connection there that you could say, if interest rates go up, profits go down.” ~Apollo Lupescu

3. Myth -Politics and the market (the President controls the markets)

Common question or comment: “If X president was in office, we would not be in this mess.”

The economy and the markets become an extension of investors’ emotions related to their personal politics. It is important to have personal values and political points of view; however, most investing decisions need to be data-driven. Being careful to differentiate between personal emotional biases and what the data tells us.

For example: Is there an obvious pattern that would tell you that having a Republican or a Democrat is better or worse for the markets? Is there evidence to suggest which political party fared better? When you look at the historical data, it is not clear that having one president, or another is better or worse for the markets.

“...In fact, President George W.Bush was extremely business-friendly, and cut taxes, specifically on investments. And yet during the eight years that he was in office, the market dropped. Should he be blamed for that? My answer is, absolutely not because 9-11 happened just as he came into office...” ~Apollo Lupescu

Listen to the podcast to hear how the stock market performed when Republicans had a unified government (controlled the White House, the Senate and Congress) versus when the Democrats had a unified government.

Bonus:

What is the difference between Index Funds (Indexing) and the investment approach used by Dimensional Fund Advisors?

What emerged in the 1970s, With the advent of computers and more rigorous data was a different way to think about investing. And the idea back then was that, okay, well, let's look at these companies. There might not be any reason why not to hold them, so let's consider them.

But the idea was that instead of trying to understand the behavior of these companies and form an expectation about these companies by themselves, the idea was to create a different way of looking...And the idea is that as an investor, you want to understand not the stock itself, as much as the category to which it belongs. An idea that became known as asset-class investing.